Best Courses After 12th Commerce

Quick Answer: After completing 12th Commerce, students can choose from a wide range of high-potential courses like B.Com, BBA, CA (Chartered Accountancy), CS (Company Secretary), CMA, Bachelor of Economics, BMS, and Law (BA LLB). For those interested in finance and global markets, courses like BBA in Finance, Bachelor in Banking and Insurance, and International Business are also popular. This guide explores the top career-oriented courses after 12th Commerce, highlighting their scope, eligibility, duration, and salary potential—so you can make an informed choice for a successful future.

Introduction

Choosing the right course after 12th commerce is a decision that can define your future career trajectory, salary potential, and personal growth. With an array of degree programs, professional certifications, diploma courses, and emerging interdisciplinary options available, commerce students today have more opportunities than ever to shape a successful career. This comprehensive guide is designed to help you navigate through the best courses after 12th commerce—from traditional degrees like B.Com, and BBA to cutting-edge courses in IT and data science—so that you can make an informed decision based on your interests, skills, and career goals.

In this guide, you will discover:

- The best degree programs after 12th commerce and their specializations.

- High-impact professional courses and certifications that boost your employability.

- Job-oriented diploma and short-term courses that offer quick entry into the job market.

- Emerging fields such as IT and data science tailored for commerce students.

- Study abroad opportunities and banking/finance courses to expand your horizons.

- Future career trends, salary insights, and tips on choosing the right course.

1. Why Choose Commerce?

The commerce stream is not just about numbers—it is about understanding the economic forces that drive businesses, markets, and societies. It develops analytical skills, strategic thinking, and a strong foundation in finance and management. Here are some key reasons why commerce is a promising choice:

- Wide Range of Career Opportunities: Whether you are interested in finance, management, IT, or law, commerce opens multiple career paths.

- High Salary Potential: Careers in investment banking, chartered accountancy, and data analytics offer some of the highest salary packages.

- Versatility: Commerce courses often allow for lateral movement between fields—for example, transitioning from a B.Com to an MBA or from a BBA to specialized certifications.

- Global Relevance: The skills learned in commerce are applicable worldwide, giving you the flexibility to work in international markets.

- Entrepreneurship: With a strong background in commerce, many students launch successful businesses, leveraging their financial and management acumen.

2. Best Degree Courses After 12th Commerce

A degree lays the foundation for your career by providing comprehensive theoretical knowledge and practical insights. Here are the most popular and career-enhancing degree courses:

2.1 Bachelor of Commerce (B.Com)

Overview:

B.Com is the most traditional and versatile degree for commerce students. It covers core subjects such as accounting, finance, business law, taxation, and economics.

Specializations:

- B.Com (General): Broad-based program covering multiple aspects of commerce.

- B.Com in Accounting & Finance (BAF): Focuses on accounting principles, financial management, and corporate finance.

- B.Com in Banking & Insurance (BBI): Tailored for careers in the banking, financial services, and insurance sectors.

- B.Com in Financial Markets (BFM): Ideal for those interested in stock markets, investment analysis, and trading.

Career Opportunities & Salaries:

| Career Role | Average Salary (INR) |

|---|---|

| Accountant | 3 - 6 LPA |

| Tax Consultant | 4 - 8 LPA |

| Financial Analyst | 5 - 10 LPA |

| Investment Banker | 10 - 30 LPA |

Why Choose B.Com?

B.Com graduates have the flexibility to pursue further studies (such as CA, CMA, CFA, or an MBA) and secure positions in corporate finance, auditing, and government sectors.

2.2 Bachelor of Business Administration (BBA)

Overview:

BBA focuses on the fundamentals of business and management, preparing students for leadership roles in various industries.

Specializations:

- BBA in Marketing: Emphasizes digital marketing, consumer behavior, and brand management.

- BBA in Finance: Concentrates on investment, risk management, and financial planning.

- BBA in International Business: Prepares students for careers in multinational corporations and global trade.

Students pursuing finance specializations learn to evaluate various business funding options including cash flow loans - term loans based on a company's earnings capacity rather than physical collateral. This knowledge is particularly valuable for careers in investment banking, private equity, and corporate finance advisory.

Career Opportunities & Salaries:

| Career Role | Average Salary (INR) |

|---|---|

| Marketing Manager | 6 - 12 LPA |

| Business Analyst | 8 - 20 LPA |

| HR Manager | 7 - 15 LPA |

Why Choose BBA?

BBA is ideal for those who aspire to pursue an MBA later and quickly move into managerial roles, thanks to its focus on practical business skills and leadership development.

2.3 Bachelor of Computer Applications (BCA)

Overview:

BCA is designed for commerce students who are interested in the technology sector. It combines computer science with business applications.

Key Areas Covered:

- Software Development

- Database Management

- Web Technologies

- Cybersecurity and IT Management

Career Opportunities & Salaries:

| Career Role | Average Salary (INR) |

|---|---|

| Software Developer | 6 - 12 LPA |

| Data Scientist | 10 - 30 LPA |

| Cybersecurity Analyst | 8 - 20 LPA |

Why Choose BCA?

BCA bridges the gap between commerce and technology, opening opportunities in the booming IT sector, fintech, and data analytics.

2.4 Bachelor of Economics (BA Economics)

Overview:

BA Economics is for students with a keen interest in data analysis, research, and economic policies. It develops strong analytical and quantitative skills.

Career Opportunities & Salaries:

| Career Role | Average Salary (INR) |

|---|---|

| Economist | 8 - 20 LPA |

| Data Analyst | 6 - 15 LPA |

| Policy Analyst | 10 - 25 LPA |

Why Choose BA Economics?

This course is a stepping stone to careers in central banks, financial research organizations, and policy-making institutions.

2.5 Bachelor of Laws (LLB)

Overview:

LLB is for commerce students interested in corporate and business law. It can be pursued as a five-year integrated course after 12th or as a three-year degree after graduation.

Specializations:

- Corporate Law

- Intellectual Property Rights

- Cyber Law

Career Opportunities & Salaries:

| Career Role | Average Salary (INR) |

|---|---|

| Lawyer/Legal Advisor | 6 - 18 LPA |

| Corporate Counsel | 8 - 25 LPA |

Why Choose LLB?

LLB provides a strong legal foundation and is essential for careers in corporate law, legal consultancy, and even public administration (like UPSC).

3. High-Paying Professional Courses and Certifications

Professional courses and certifications can significantly boost your career prospects by providing specialized skills that are in high demand.

| Course/Certification | Focus Area | Salary Range (INR) | Duration |

|---|---|---|---|

| Chartered Accountancy (CA) | Accounting, Auditing, Taxation | 10 - 40 LPA | 3 - 5 years |

| Company Secretary (CS) | Corporate Law, Compliance | 6 - 20 LPA | 3 years |

| Chartered Financial Analyst (CFA) | Investment Banking, Stock Markets | 12 - 50 LPA | 2 - 3 years |

| Certified Management Accountant (CMA) | Cost Accounting, Financial Analysis | 8 - 25 LPA | 2 - 3 years |

| Digital Marketing Certification | SEO, Social Media, PPC | 5 - 15 LPA | 6 months - 1 year |

| Financial Risk Manager (FRM) | Risk Management | 10 - 30 LPA | 1 - 2 years |

Why Choose Professional Certifications?

- They are highly valued by employers.

- They offer specialized knowledge and skills.

- They often lead to higher starting salaries and quicker career advancement.

In addition to traditional banking roles, students exploring careers in finance can also look into business finance options like startup business funding, working capital management, or even asset finance options. These areas are particularly valuable for aspiring entrepreneurs and professionals interested in supporting small and medium enterprises (SMEs) with customized financial solutions.

4. Diploma and Short-Term Courses After 12th Commerce

If you are looking for quick, job-oriented programs, diploma and short-term courses are an excellent choice. These courses provide practical skills that help you get a head-start in the job market.

| Course | Focus Area | Duration | Career Opportunities |

|---|---|---|---|

| Diploma in Banking & Finance | Banking operations, financial services | 6 months - 1 year | Bank PO, Financial Service Representative |

| Diploma in Digital Marketing | SEO, Social Media, Content Marketing | 3 - 6 months | Digital Marketer, Social Media Manager |

| Diploma in Data Analytics | Data visualization, business intelligence | 6 months - 1 year | Data Analyst, Business Intelligence Associate |

| Diploma in Financial Accounting | Accounting software, GST, Tally | 6 months - 1 year | Junior Accountant, Bookkeeper |

| 6-Month Certificate Course in Fintech | Blockchain, digital finance, cybersecurity | 6 months | Fintech Specialist, Cybersecurity Analyst |

Why Choose Diploma Courses?

- They are short-term and skill-focused.

- They offer a quick entry into the workforce.

- They complement degree courses by adding practical expertise.

5. IT & Data Science Courses for Commerce Students

The integration of technology in finance and business has created a huge demand for professionals who understand both commerce and IT. Consider the following courses:

| Course | Focus Area | Duration | Career Opportunities |

|---|---|---|---|

| BCA (Bachelor of Computer Applications) | Software development, IT management | 3 years | Software Developer, IT Consultant |

| Diploma in Data Science | Data analytics, machine learning | 6 months - 1 year | Data Scientist, Data Analyst |

| Python & SQL Certification | Programming for data handling | 3 - 6 months | Data Analyst, Business Intelligence Specialist |

| Fintech Certification | Digital banking, blockchain | 6 months - 1 year | Fintech Specialist, Digital Finance Analyst |

Why Choose IT & Data Science Courses?

- Commerce students can leverage these skills to enter high-demand sectors.

- They provide a competitive edge by combining commerce with technology.

- They open up opportunities in emerging fields such as fintech, AI, and cybersecurity.

6. Banking & Finance Courses After 12th Commerce

For students passionate about the financial markets and banking, the following courses can help build a robust career:

| Course | Focus Area | Duration | Career Opportunities |

|---|---|---|---|

| B.Com in Banking & Insurance | Banking operations, insurance | 3 years | Bank PO, Insurance Advisor, Loan Officer |

| Diploma in Banking & Finance | Practical banking skills | 6 months - 1 year | Banking Associate, Financial Service Executive |

| Certified Financial Planner (CFP) | Wealth management, financial planning | 1 - 2 years | Financial Planner, Wealth Manager |

| MBA in Finance | Advanced financial management | 2 years (post-graduation) | Investment Banker, Financial Analyst |

Why Choose Banking & Finance Courses?

- They provide specialized training in the dynamic financial sector.

- They are highly valued in both public and private sectors.

- They offer opportunities in high-growth areas such as investment banking and wealth management.

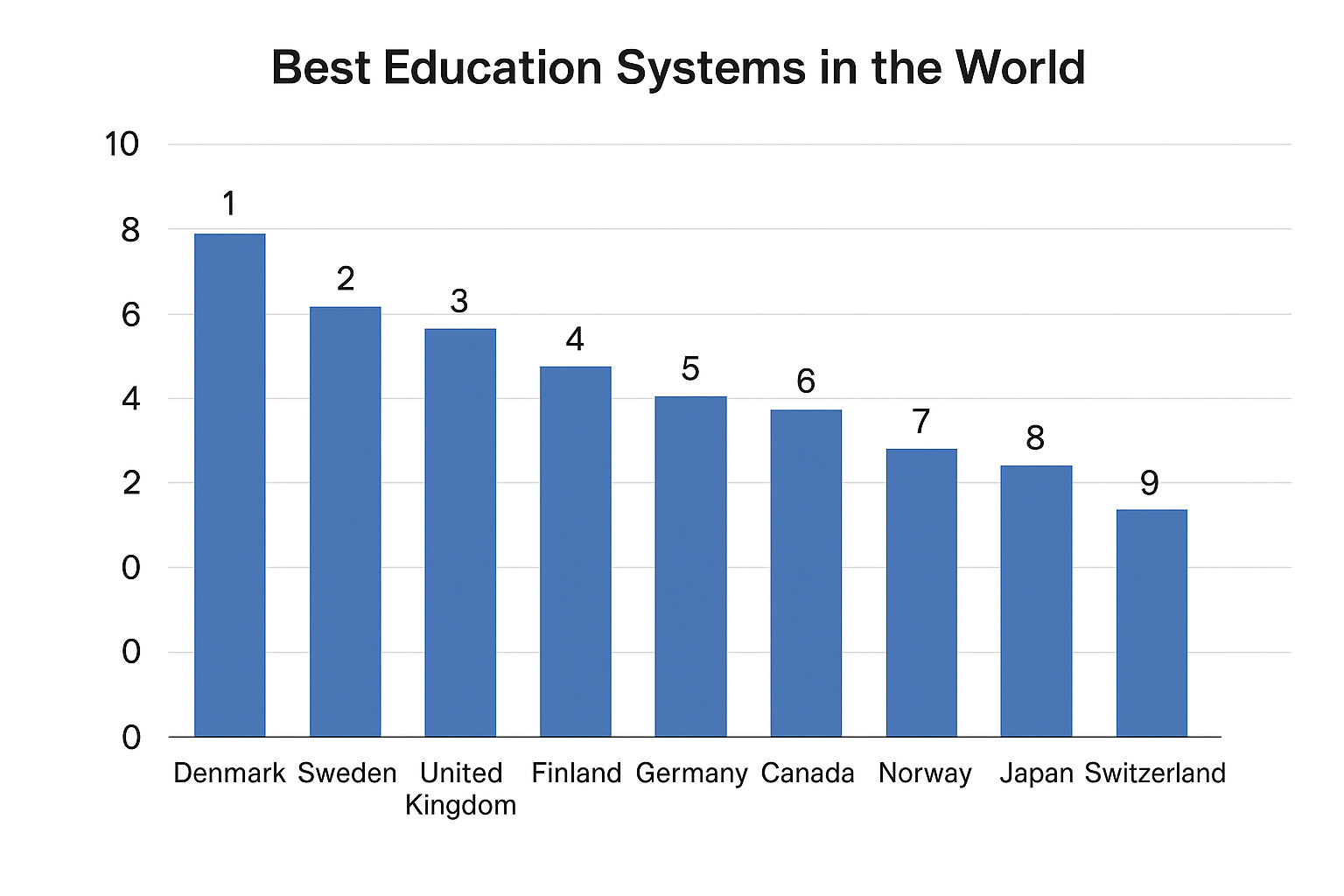

7. Study Abroad Opportunities After 12th Commerce

Studying abroad can broaden your horizons and expose you to international business practices. Here are some popular options:

| Country | Popular Courses | Duration | Career Prospects |

|---|---|---|---|

| USA | BBA, Finance, Business Analytics | 3 - 4 years | Multinational Corporations, Global Markets |

| Canada | BBA, Accounting, Digital Marketing | 3 years | High-paying jobs in North America |

| UK | BBA, Economics, Finance | 3 years | Opportunities in London’s financial hub |

| Australia | BBA, International Business, Marketing | 3 years | Growing market, high quality of education |

Why Consider Studying Abroad?

- Exposure to global business practices.

- Access to higher salary packages and diverse career opportunities.

- Networking with international peers and professionals.

8. Future Career Trends and Salary Insights for Commerce Graduates

As the commerce landscape evolves, new career paths continue to emerge. The integration of technology, the rise of digital marketing, and the global expansion of financial services are reshaping the industry.

| Career Option | Average Salary (INR) | Growth Outlook | Key Skills |

|---|---|---|---|

| Chartered Accountant (CA) | 10 - 40 LPA | High – consistent demand | Accounting, Auditing, Taxation |

| Investment Banker | 12 - 50 LPA | Very High – global expansion | Financial Modeling, Risk Analysis |

| Data Scientist | 10 - 30 LPA | Rapid – tech-driven | Analytics, Machine Learning, Python |

| Digital Marketing Manager | 5 - 15 LPA | High – digital transformation | SEO, Social Media, PPC |

| Financial Analyst | 6 - 20 LPA | High – diversified markets | Analytical Skills, Excel, Research |

Key Takeaway:

Commerce graduates who continuously upgrade their skills and combine domain expertise with technology are poised for lucrative and dynamic career paths.

9. How to Choose the Right Course After 12th Commerce?

Making the right choice requires self-assessment and market research. Here are some steps to help you decide:

Assess Your Interests and Strengths:

- Do you enjoy working with numbers, or are you more inclined towards management and strategy?

- Are you interested in technology, or do you prefer traditional finance and accounting roles?

Research Market Trends:

- Look at emerging career trends such as fintech, data science, and digital marketing.

- Consider the long-term salary potential and job stability of each field.

Consult Experts and Mentors:

- Speak with career counselors, industry professionals, and alumni.

- Attend career fairs and webinars to gather insights.

Consider Further Studies:

- If you plan on pursuing higher studies (MBA, CA, etc.), choose a course that aligns with your long-term academic goals.

Evaluate Course Duration and Cost:

- Determine whether you prefer a quick diploma for early job entry or a longer degree program for comprehensive knowledge.

Related

Make AI Presentations for Free

10. Frequently Asked Questions (FAQs)

Q1. Which course after 12th commerce offers the highest salary?A1. Professional courses like Chartered Accountancy (CA), CFA, and MBA in Finance typically offer the highest salary packages. Additionally, data science and IT certifications can yield competitive salaries.

Q2. Which diploma course is best for commerce students?A2. Diploma in Banking & Finance and Diploma in Digital Marketing are excellent choices for immediate job opportunities in the financial and digital sectors.

Q3. Can commerce students enter the IT sector?A3. Yes. With courses like BCA and certifications in data science, Python, and SQL, commerce students can successfully transition into the IT and fintech sectors.

Q4. What are the study abroad options for commerce graduates?A4. Countries like the USA, Canada, UK, and Australia offer robust programs in business administration, finance, and marketing that are well-recognized internationally.

Q5. How can I choose between a degree, diploma, or certification?A5. Consider your career timeline—if you want early job entry, a diploma or certification may be best. For long-term growth and in-depth knowledge, a degree is advisable.

Conclusion

The commerce field today is more versatile and dynamic than ever before. Whether you opt for a traditional degree such as B.Com, BBA, or BA Economics, or choose specialized professional courses and diplomas in banking, IT, or digital marketing, your choice should align with your personal interests and long-term career goals.

By staying informed about emerging trends, upgrading your skills, and leveraging both academic and professional courses, you can secure a high-paying, rewarding career in commerce. Use this guide as a roadmap to explore your options, compare different paths using our detailed tables, and make the best decision for your future.

Choose wisely and invest in your career today for a prosperous tomorrow.